Oct 22, 2013 | Change, Demand chains, Marketing, Strategy

The success of the last 250 years in western economies is based on the economies of scale. Harnessing technology to deliver greater productivity per unit of input, capital, labour, and raw material.

All industries have been disrupted from the cottage stage to industrial, and the change has spawned industries unimaginable even to our fathers.

Agriculture has been no different, “factory farming” is the standard, even it is it still outside in a paddock.

It now would appear to me that there are the beginnings of a reverse disruption, accompanied and enabled by the removal of organisational and arbitrage barriers enabled by the web. Words and phrases like “Local” “sustainability ” fresh” “product provenance” and “demand driven” keep on coming through. A small but increasing number of consumers are seeking out products that deliver these promises, and a few specialist retailers are suddenly seeing the emergence of a consumer group who will not be seduced by the giant retail chains.

A semantic disruption?

Agriculture in the Sydney basin has been under pressure from development for the last 50 years, and with some exceptions concentrated in intensive industries, has become increasingly marginal. There is not much left to meet the demands of this consumer driven semantic disruption as it evolves. However, those who are left, both producers and specialist retailers, have an opportunity to alter their business to leverage the emerging disruption.

Oct 21, 2013 | Communication, Governance, Lean, Operations

I had a post prepared for this morning, relating to the evolution of “local” agriculture, specifically around Sydney.

However, the events of the weekend, the burning of Sydney’s surrounding bushland, including several of the farms of those I have been talking to, seems to make everything else trivial by comparison. Getting your head around the scale of the fire disaster facing us is difficult, for most of us, most of the time, as it is no-one close to us who is affected, so can be pushed aside as we go about our business.

This morning is different.

Walk outside your comfy suburban home, and look at the sky, smell the smoke, observe the odd orange light, and you just know this is different, it is not just another Sydney summer bushfire. Hurts to wonder what may happen when summer actually gets here.

As we watch and listen to the news reports, there is a huge application of technology and human effort to managing the logistics of the fire-fighting effort, but one shot on a news report caught my attention. Behind all the activity of the control centre, the people on phones and computers, handling reports and updates, stood a big whiteboard, what appeared to be a visual record of the fires, their relative risk, resources deployed, resources expected and in reserve.

It always happens, people relate to visual material, when under pressure, a picture can immediately summarise a situation that words alone cannot, so they tend to gravitate to pictures, or a whiteboard in a large group situation, something that can be kept up to date in real time, that all people who need to see it, can see it as it evolves. The whiteboard is perhaps the best collaboration tool ever invented.

When the fires are out, the cleanup someone elses problem, and the inevitable wrangling with insurance is the news topic of the day, the lessons of visual should remain with all of us as we go about improving the way we go about achieving goals.

Our thoughts go to all those who have been impacted by the fires, ands will be over the next few days as the fires continue to ravage Sydney’s bush outskirts. Our grateful thanks for the courage, and committment of the “fireies”

Oct 18, 2013 | Marketing, Personal Rant

Bushfires are raging, again, around NSW, houses lost, businesses destroyed, kids stressing out because they cannot get to HSC locations, and “fireies” putting themselves in harms way.

Yet, we watch, are concerned, but go about our dailies as best we can.

Last weekend my sons car was one of those caught in the fire at Olympic park, another of the many started by some idiot $???%%$# throwing a cigarette.

Whilst it was just a car, well insured, and with few personal things in it, the impact on our emotions as we waited to find out if his was one of the 43 destroyed was significant, because it was close to us, happened to us, and not somebody we did not know.

It is the same in all aspects of our lives, the closer we get, the more we feel it, whatever “it” is.

Herein lies the fundamental truth about marketing.

Understanding what is happening in a consumers mind, how they are responding to some stimulus, how their emotions are playing out, in response to the stimulus you are delivering, is the key to engaging with them.

My Dad always repeated the advice of Niccolo Machiavelli, to hold your friends close, but your enemies closer, but it seems to me that adding your customers to that list of bosom buddies is also crucial.

Oct 17, 2013 | Branding, Category, Customers, Innovation, Marketing

Cottage cheese is a pretty dull category in supermarkets. A relatively tasteless, low calorie (therefore it must taste crappy, right?), price competitive, group of products.

Yes, so we thought.

Years ago, 25 years in fact, I was the GM Marketing of a major Australian diary company with the leading brand of Cottage cheese. I thought all of the above, and we struggled to make any return, let alone one that was a competitive use of the capital tied up.

We had very good data, for the time, remembering this is pre-internet. We knew who sold our, and competitive brands in what quantities, and pretty much to whom, as we had good U&A (usage and attitude) data. As a result we were able to segment the market pretty well by usage, demographics, geography, and basket. However, whatever we did, we had trouble moving the sales needle.

Almost as a last resort, we ran a small recipe competition on the side of the packs, easy, low cost, a prize draw of a holiday at a health resort on the Gold Coast. We got a few hundred entries, a failure by our pre-agreed metrics, so we thought we knew something else that did not work. However, because there were so few, we took the time (there was a young work experience person to utilise at the time) to write back to all the entrants saying thanks for entering, and sending them a few of the top recipes we had received, just to be polite.

The response astonished us.

A very high number wrote back saying thanks for the recipes, and telling us how they used the products, what was right and wrong about them, all sorts of information we did not have, or had not thought was relevant.

Turned out, cottage cheese was not a “calorie avoidance food” it had uses in all sorts of areas by all sorts of people we had not seen as in our market, in fact, had not considered. The job we assumed was being done by cottage cheese, deduced by looking at our data, from our perspective, was not the job that consumers were hiring the product to do.

Long story short, we slowly built a database, all done by hand and snail mail, so it was a significant resource sink, a cottage cheese club in effect that shared recipes, stories, and funny events. All pretty mundane these days with the tools available, but a major undertaking in 1988.

Our sales went up, our promotional spend with retailers dropped, our price sensitivity reduced significantly, and had several successful range extensions, and we suddenly were making very good returns.

The moral is, make sure you understand the job that consumers hire your product to do, make sure you see it through the consumers eyes, not yours.

Oh, and two more lessons,

1. Social media marketing is not new, just the tools now availabel make it easier, so now everybody is doing it.

2. Cottage cheese is really very nice, 20 years after leaving the company, i still buy and use the product, in all sorts of odd ways, learnt from the “clubbies”. Brand building by another name.

Oct 16, 2013 | Change, Collaboration, Marketing

Intelligent design is a huge discredited furphy perpetrated by Christian fundamentalists in the US on sections of the school system.

But, taking the notion of viewing something through an entirely different lens a bit further, intelligent re-design becomes a notion that offers the thought that business models can sometimes be, and often should be, turned on their heads as a way of evolving.

Often I find myself between things, having time to kill before the next commitment, and I sometimes spend that time in a café having a coffee, and reading, thinking, and generally just contemplating.

It occurred to me the other day whilst indulging in such a contemplation, that I was not buying a coffee, I was buying a pleasant location to spend time, the coffee was just the excuse.

In effect, I was paying for time, not buying a coffee.

In most cases, there is the apparent reason stuff happens, then when you scrape away, the real reason sometimes becomes apparent. People who buy expensive cars are not buying transport, they are buying an object that says something about them to others, just as my coffee is an excuse to sit quietly in a cafe.

It is the articulation of this “real reason”, difficult as it usually is to articulate, where great value can be created. The breakthrough over the last few years that is enabling much of the development is the two sided market capability enabled by the web. Participants in the so called “collaborative economy” a term popularised by Jerry Owyang are all busily re-designing business models all over the place.

Oct 15, 2013 | Marketing, Social Media

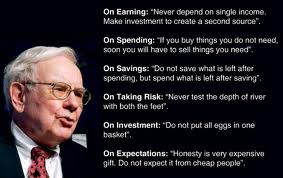

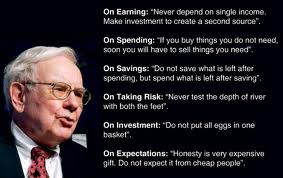

Wisdom of Warren Buffett

We are rushing headlong towards automating the marketing process, everything from the call centre systems to advanced automation like Marketo and others. However, we are social animals, and no matter how much we set out to automate, you simply cannot replace the eyeball to eyeball impact of personal meetings, creating a paradox.

There is an ad in the current HBR magazine, a portrait of Warren Buffett asking “Ever give a firm handshake over a speaker phone”? Warren is known for asking the key question, of breaking complications down to their core elements, and valuing simplicity. Marketing automation is far from simple, leveraging as it does, assumptions built into strings of algorithms, driving automatic responses.

The real benefit of the tech solutions are the opportunities the tools offer for productivity improvements in the way we use our time to prospect, engage, and sometimes transact, but it will always take a person to take an automated exchange, and turn it into the process that leads to a human relationship.

The old metaphor of using a hammer to drive a nail, not a screwdriver applies in spades. The software being marketed are just tools to be used by people, some tools are better, and more appropriate than others, and the skill of the user plays a huge role.

Don’t be fooled about just how hard it is to use these tools well, and know they cannot ever take the place of personal interaction.